income tax plus self employment tax

You had church employee income of 10828 or more. Ad Free Prep Print E-File Start Your Tax Filing Today.

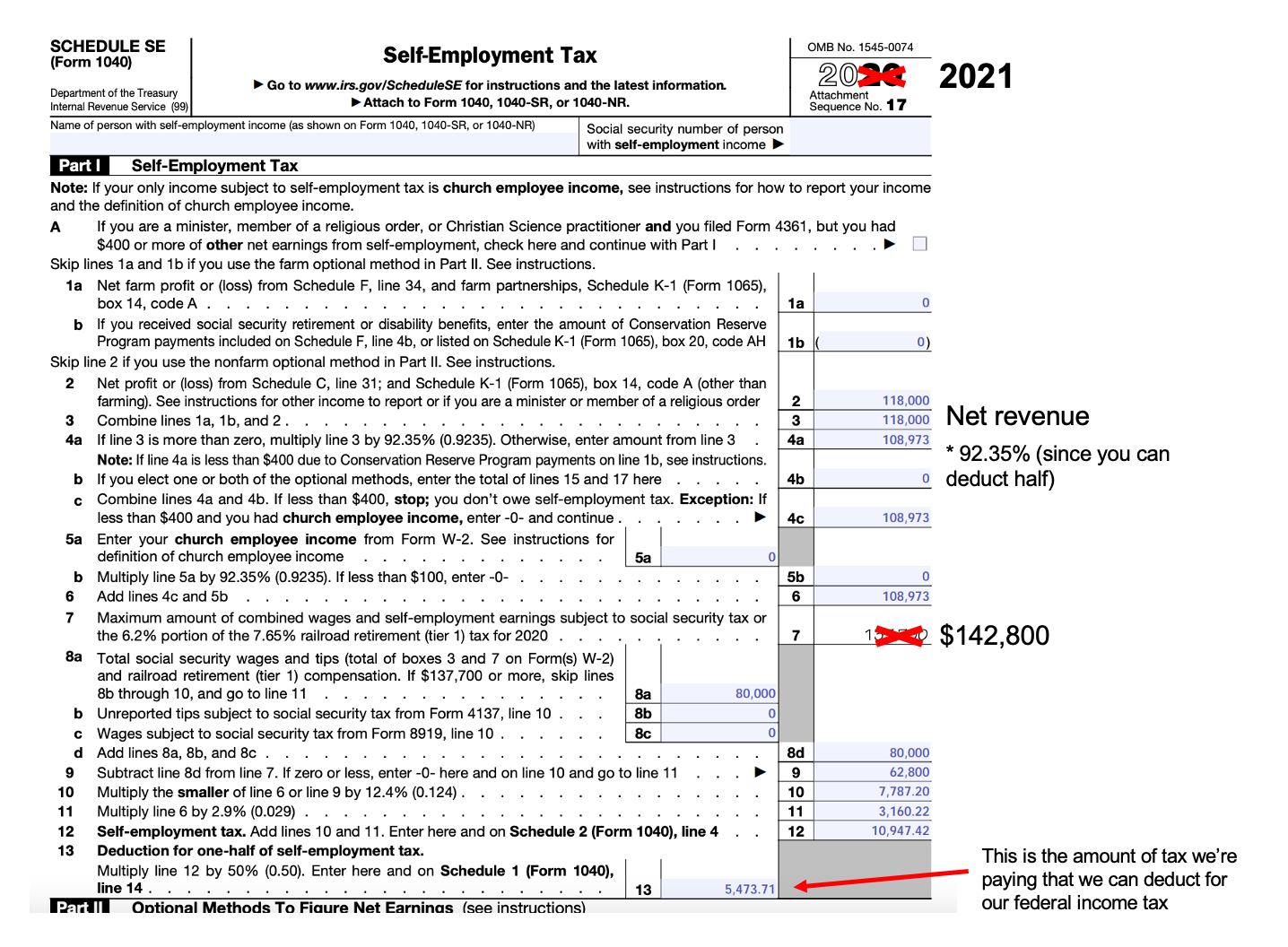

Reporting Self-Employment Tax.

. That rate is the sum of a 124 Social Security tax and a 29. According to the IRS self-employed individuals are required to pay self. Easily Approve Automated Matching Suggestions or Make Changes and Additions.

Pays for itself TurboTax Self-Employed. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. This income is generally subject to regular income tax and could also be subject to self-employment tax with some notable exceptions.

Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. For 2021 employees pay 765 percent of their income in Social Security and Medicare taxes with their employers making an additional payment of 765 percent. IR-2019-149 September 4 2019.

Easily Approve Automated Matching Suggestions or Make Changes and Additions. Resident within the meaning of Internal Revenue. You must pay SE tax and file IRS Form 1040 Schedule SE Self-Employment Tax if either of the following applies.

As noted the self-employment tax rate is 153 of net earnings. The self-employment tax rate is 153. Well here it is.

The Self-Employed Contributions Act SECA is the name of the tax on self-employment. This tax paid by self-employed individuals is known as the SECA or more simply the self-employment tax. However the Social Security portion may only apply to a part of your business.

Develop A Tracking System. Your employment wages and tips should have a 62. This is your total income subject to self-employment taxes.

We have the largest selection at the best prices. Taxes Paid Filed - 100 Guarantee. The self-employment tax rate for 2021-2022.

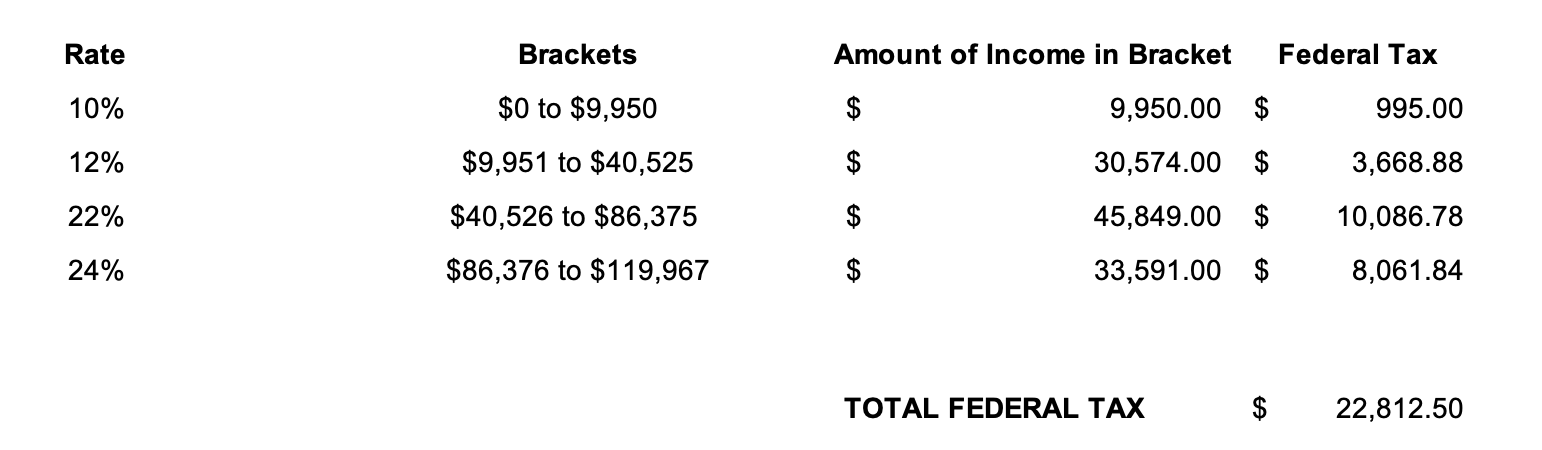

To calculate your income tax were going to assume that youre a single filer with no additional tax deductions or credits besides the self-employment tax deduction. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. Self-employed workers are taxed at 153 of the net profit.

Discover How To Manage Your Taxes If Youre Suddenly Self-Employed. In 2022 income up to 147000 is subject to the 124 tax paid for the Social Security portion of self-employment taxes FICA. WASHINGTON The Internal Revenue Service said.

Freelancers others with side jobs in the gig economy may benefit from new online tool. Citizen or a US. Ad Foil Stamped Tax Folders Software Slip Sheet Folders Client Copy and More.

Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. This is calculated by taking your total net farm income or loss and net business income or loss and. Compute self-employment tax on Schedule SE Form 1040.

When figuring your adjusted gross income on Form 1040 or Form 1040-SR. The SE tax is the way the Feds collect Social Security and Medicare taxes on non-salary income from work-related activities. The second portion of your self.

The dreaded self-employment tax. Use this Self-Employment Tax Calculator to estimate your. Learn More At AARP.

If youre used to the normal W2 structure switching to self-employment taxes comes with a large learning curve. The Internal Revenue Code imposes self-employment tax on the self-employment income of any individual who is a US. The self-employment tax rate is 153 with 124 for Social Security and 29 for Medicare.

Ad Find Advice On Navigating Deductions and Paying Self-Employment Taxes. This percentage is a combination of Social Security and Medicare tax. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage.

The rate consists of two parts. The calculator took one of these for you known as the self employment deduction. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Adjusted Gross Income AGI is your net income minus above the line deductions. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

Schedule Se And 1040 Year End Self Employment Tax Stripe Help Support

Self Employed Federal Income Taxes Turbotax Tax Tips Videos

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Missouri Income Tax Rate And Brackets H R Block

Tax Tips For Self Employed Plus Self Employment Taxes Reminder Small Business Tax Tax Services Business Tax

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

10 Key Tax Deductions For The Self Employed

Self Employment Tax What It Is How It Works And How You Can Save Ey Us

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

2022 2023 Self Employment Tax Calculator

When Are Taxes Due In 2022 Forbes Advisor

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Everything You Need To Know About Self Employment Tax Self Employment Tax Business Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

What Is Self Employment Tax And What Are The Rates For 2020 Workest

Self Employment Tax Everything You Need To Know Smartasset

1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary